Top Reasons You Need Critical Illness Insurance

Critical Illness Insurance

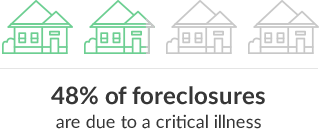

A cancer diagnosis, heart attack or other unforeseen health crisis could leave you unable to earn an income, adding financial stress to an already emotionally stressful situation. Unfortunately, your mortgage or rent payment and other monthly expenses will still need to be paid. On top of those obligations, medical bills can quickly pile up. If you aren't able to work, you may not have the means to pay those bills.

Critical illness insurance is a policy that will pay out a benefit as a lump sum if you are diagnosed with a critical illness or condition specified in the policy. This can relieve or lessen the financial strain that can come with critical illnesses, so you can focus on getting better.

As you go through life, your insurance needs change.

Symmetry Financial Group provides plans to keep you protected.

Why Do I Need

Critical Illness Insurance?

None of us knows if or when we will contract cancer, have a heart attack or stroke, or be diagnosed with another critical illness. These diseases and conditions can have devastating effects on our health, requiring dedicated treatment and recovery periods. When a critical illness strikes, the financial consequences can be just as catastrophic as the health ramifications in their own way. Consider this: an estimated 56 million Americans under age 65 have trouble paying medical bills, and medical bills are the number one reason for bankruptcies.

Even with a good health insurance policy, you may still be required to pay a sizable deductible before your health insurance kicks in, and then you may need to continue paying co-insurance to cover a portion of your own health care costs.

Critical illness insurance is designed to help alleviate the financial strain that comes with critical illnesses. The lump sum benefit paid out under a critical illness insurance policy can be used to pay your medical bills, mortgage and other expenses. Policy benefits can also be used to pay for experimental treatments not covered by your health insurance policy, or for travel to obtain treatments somewhere other than your current location.

Why Do I Need

Critical Illness Insurance?

None of us knows if or when we will contract cancer, have a heart attack or stroke, or be diagnosed with another critical illness. These diseases and conditions can have devastating effects on our health, requiring dedicated treatment and recovery periods. When a critical illness strikes, the financial consequences can be just as catastrophic as the health ramifications in their own way. Consider this: an estimated 56 million Americans under age 65 have trouble paying medical bills, and medical bills are the number one reason for bankruptcies.

Even with a good health insurance policy, you may still be required to pay a sizable deductible before your health insurance kicks in, and then you may need to continue paying co-insurance to cover a portion of your own health care costs.

Critical illness insurance is designed to help alleviate the financial strain that comes with critical illnesses. The lump sum benefit paid out under a critical illness insurance policy can be used to pay your medical bills, mortgage and other expenses. Policy benefits can also be used to pay for experimental treatments not covered by your health insurance policy, or for travel to obtain treatments somewhere other than your current location.

How Does

Critical Illness Insurance Work?

Critical illness insurance requires you to make periodic premium payments to keep the policy in force. Every policy is a little different, but critical illness policies may offer payouts ranging from $10,000 all the way to $1 million. The policy itself specifies what conditions are covered. Typically, these include cancer, heart attacks and strokes. Some policies may also cover heart disease, kidney failure, organ transplant, paralysis and other conditions.

If you contract a covered condition while the policy is in force, the insurance company will pay you the face amount of the policy, typically in one lump sum payment which is generally tax-free (talk to your tax professional to confirm tax treatment for your specific situation).

How Does

Critical Illness Insurance Work?

Critical illness insurance requires you to make periodic premium payments to keep the policy in force. Every policy is a little different, but critical illness policies may offer payouts ranging from $10,000 all the way to $1 million. The policy itself specifies what conditions are covered. Typically, these include cancer, heart attacks and strokes. Some policies may also cover heart disease, kidney failure, organ transplant, paralysis and other conditions.

If you contract a covered condition while the policy is in force, the insurance company will pay you the face amount of the policy, typically in one lump sum payment which is generally tax-free (talk to your tax professional to confirm tax treatment for your specific situation).

Choose Symmetry For Critical Illness Insurance

At Symmetry Financial Group, we pride ourselves on providing an independent, unbiased approach to helping our clients meet their insurance needs.

Rather than simply trying to sell you a specific product, we will take the time to help understand your situation including your goals, objectives and your budget. Armed with that information, we can then shop more than 30 insurance carriers to find the coverage that truly works for you.

Buying critical illness insurance now, while you're healthy, is a gift you're giving your future self and your loved ones. To learn more and to get a quote for coverage, contact us today.

Would You Like to

Request a Quote?

Please fill out the short form so we can provide you

with the policy options to best match your

coverage and financial needs.

Frequently Asked Questions

Q: What are the advantages of Critical Illness Insurance?

The main advantage of a critical illness insurance policy is the peace of mind that comes with knowing you and your family will have cash available to cover your expenses in the event you become seriously ill. You get to choose how the money is spent: use it to pay for treatment costs that aren't covered under your health insurance policy, to cover your monthly obligations, to replace your spouse's income so he/she can care for you, etc. The choice is yours.

Q: Can I afford Critical Illness Insurance?

Critical illness insurance can be surprisingly affordable, especially if you are young and relatively healthy when you purchase the policy.

When you weigh the policy premiums against the potential impact to your finances from not having coverage when you need it, buying a critical illness insurance policy just makes sense.

Q: Do I qualify for Critical Illness Insurance?

Some policies offer simplified underwriting, meaning you may be asked a series of health-related questions and may not need a medical exam. For higher value policies offering larger lump sum benefits, you will need to qualify for coverage based on medical exams and tests. In general, most healthy individuals qualify for critical illness coverage.

Because this type of policy is designed to pay out benefits in the event you are diagnosed with a critical illness, you cannot purchase the policy if you already have a critical illness.

Q: When should I buy Critical Illness Insurance?

Of course, none of us ever want to be diagnosed with any type of critical health condition, but there's no way to guarantee that won't happen. For a critical illness policy, your premiums will be based on your age, so purchasing a policy at a younger age can make the policy even more affordable.

Would You Like to Request a Quote?

Please fill out the short form so we can provide you with the policy options

to best match your coverage and financial needs.

Would You Like to Request a Quote?

Please fill out the short form so we can provide you with the policy options

to best match your coverage and financial needs.

Would You Like to Request a Quote?

Please fill out the short form so we can provide you with the policy options

to best match your coverage and financial needs.

Core Values

Our eight core values are the

driving force behind everything we do.

Largest Life Insurance Guide

Read our comprehensive guide to answer any life insurance questions you have.

Interactive Timeline

View our interactive timeline to

see what insurance is right for you

CONTACT US

DEBT FREE LIFE

Learn more about Symmetry Financial Group’s Debt Free Life program, which

can help you get out of debt in nine

years or less without spending any additional money.

PRODUCTS

• Mortgage Protection

• Final Expense

• Term Life Insurance

• Universal Life Insurance

• Disability Insurance

• Critical Illness Insurance

• Retirement Protection

• SmartStart Insurance

WHY SYMMETRY?

Copyright © 2025 Symmetry Financial Group. All Rights Reserved. | Privacy | Site Map

“Quility” is a brand name used by the Quility family of companies. All insurance offers, solicitations, and recommendations made via this website are being made by Quility’s licensed affiliated insurance producers, Symmetry Financial Group, LLC (d/b/a Symmetry Insurance Services in California) and Andrea Buth. No offers, solicitations or recommendations are being made via this website in any state where one of those named Quility licensees does not have a license. Please see our License Page for a list of all of Symmetry Financial Group, LLC’s (d/b/a Symmetry Insurance Services in California) and Stephen J. Brenes’s license numbers in each state.

CONTACT US

DEBT FREE LIFE

Learn more about Symmetry Financial Group’s Debt Free Life program, which

can help you get out of debt in nine

years or less without spending any additional money.

Andrea Buth

Copyright © 2025 Symmetry Financial Group. All Rights Reserved. | Privacy | Site Map

“Quility” is a brand name used by the Quility family of companies. All insurance offers, solicitations, and recommendations made via this website are being made by Quility’s licensed affiliated insurance producers, Symmetry Financial Group, LLC (d/b/a Symmetry Insurance Services in California) and Andrea Buth. No offers, solicitations or recommendations are being made via this website in License Page for a list of all of Symmetry Financial Group, LLC’s (d/b/a Symmetry Insurance Services in California) and Zak & Andrea Buth’s license numbers in each state.

No agent’s success, earnings, or production results should be viewed as typical, average, or expected. Not all agents achieve the same or similar results, and no particular results are guaranteed. Your level of success will be determined by several factors, including the amount of work you put in, your ability to successfully follow and implement our training and sales system and engage with our lead system, and the insurance needs of the customers in the geographic areas in which you choose to work.

custom_values.agent_bio=With 25+ years of providing solutions for life insurance, mortgage protection, final expense, retirement, debt elimination and more and access to over 30 of the top carriers, we can help you find personalized coverage to fit your budget and health challenges. Solutions also include "living benefits" and no health exam! Zak and Andrea have 4 children, 1 son in law, 1 daughter in law, 2 granddaughters and 1 grandson! They live in Lake Mills, WI.

custom_values.agent_brokerage=Buth Family Financial

custom_values.agent_headshot=https://storage.googleapis.com/contact-attachments-live/sCHHsN91XVzw14qKIzeq/MTBtTJLSe57XWnioeFPs/cff03ab8-0366-4c3b-ae8c-43ba4e355634.jpg

custom_values.agent_name=Andrea Buth

custom_values.agent_phone=(920) 650-8650

custom_values.agent_title=

custom_values.agentemail=

custom_values.booking_page_link=

custom_values.booking_thank_you_page=

custom_values.brag_link=

custom_values.claim_thank_you_page=

custom_values.confirm_sale=

custom_values.final_expense_booking_page=

custom_values.from_email=

custom_values.insurance_license_number=

custom_values.life_insurance_landing_page=

custom_values.logo_image_url=

custom_values.outbound_email=

custom_values.recruiting_booking_link=

custom_values.twilio_number=(920) 567-3330

custom_values.twilio_number_in_link_form=Tel:(920) 567-3330

custom_values.licensenumber=

buthzak@gmail.com

SFG0023379

(920) 567-3330

Tel:(920) 567-3330

6ltOeqpZsp0KBOIxQBjH